The European Commission has published explanations from the Directorate-General for Financial Stability, Financial Services and Capital Markets Union (DG FISMA) . According to these explanations, neither legal entities nor individuals from the European Union are allowed to participate in the asset exchange scheme proposed by Russia.

The reason for this ban is the participation of the National Settlement Depository (NSD), a central securities depository of the Russian Federation and part of the Moscow Exchange group, which has been sanctioned since June 2022.

“All funds and economic resources belonging to, owned, held or controlled by NSD must be frozen, and no funds or economic resources can be made available to it, whether directly or indirectly,” the European Commission noted.

At the same time, the European Commission is aware that Russia has started implementing an “asset swap” scheme on 22 March 2018 within the framework of presidential decree 844.This scheme will allow Russian retail investors to submit offers to exchange western securities, which are currently frozen in NSD accounts in EU central securities depositories (CSDs) in exchange for “unfriendly” investors’ funds that are blocked in Russia in C-type accounts.

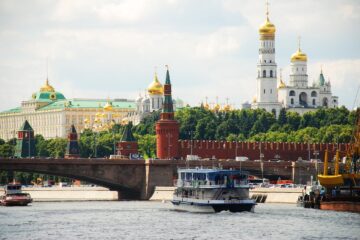

National Settlement Depository is a key component of the Russian financial infrastructure. NSD is a member of the Moscow Exchange Group and operates from its offices in Moscow.