The U.S. Department of the Treasury has announced new sanctions on Russia. These sanctions could cause the ruble to fall.

“Today’s actions strike at their remaining avenues for international materials and equipment, including their reliance on critical supplies from third countries. We are increasing the risk for financial institutions dealing with Russia’s war economy and eliminating paths for evasion, and diminishing Russia’s ability to benefit from access to foreign technology, equipment, software, and IT services. Every day, Russia continues to mortgage its future to sustain its unjust war of choice against Ukraine,” said Secretary of the Treasury Janet L. Yellen.

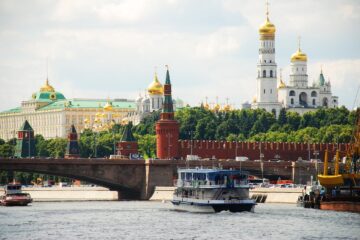

Treasury has targeted the architecture of Russia’s financial system.

The US has imposed sanctions on Moscow Exchange (MOEX), which operates Russia’s largest public stock, fixed-income, foreign exchange, and money markets

.After the imposition of sanctions, the Moscow Exchange is unable to form the exchange rate of the ruble against the dollar and the euro.

The Central Bank of Russia has already issued a statement reassuring Russians. The bank claims that transactions with US dollars and euros will continue to be conducted on the over-the-counter market and, to determine the official exchange rates for US dollars and euro against rubles, the bank will use bank statements and information obtained from digital platforms for over-the counter trading. Companies and individuals can also continue buying and selling US dollars and Euros through Russian banks.