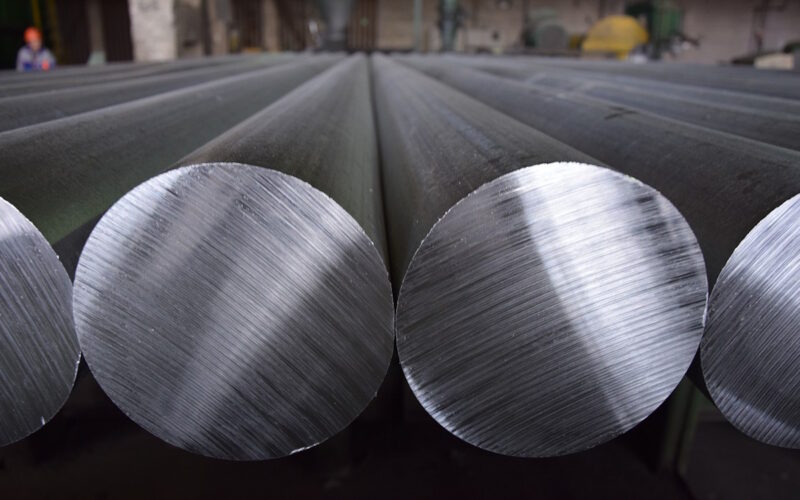

On April, 12 the United States, in coordination with the United Kingdom have imposed sanctions to disrupt Russian revenue from its metals trading by prohibiting the importation into the U.S. and UK of aluminum, copper, and nickel of Russian origin.

Now, the London Metal Exchange (LME) and the Chicago Mercantile Exchange (CME) will no longer trade new Russian-produced aluminum, copper and nickel.

“By taking this action in a targeted and responsible manner, we will reduce Russia’s earnings while protecting our partners and allies from unwanted spillover effects.”

Secretary of the Treasury Janet L. Yellen

The ban on trading has caused prices at the London Metal Exchange to rise, with aluminum prices surging more than 9% on Monday.

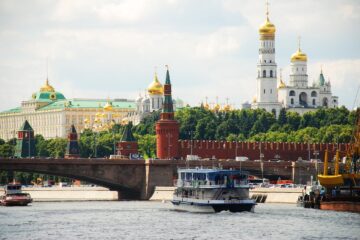

As a consequence, the securities of Russian metallurgical companies have been getting cheaper on the Moscow Exchange (MOEX). For example, the shares of RUSAL, a leading company in the global aluminum industry, have lost around 2% as of 10 am on April 15.

Previously, RUSAL had warned that new sanctions against Russian aluminum would hit European small and medium-sized companies that are an important part of the European economy, responsible for around 70% of aluminum turnover and 92% of employment in the industry.